26+ tax deduction on mortgage

Mortgage interest can be deducted on the. Ad Browse discover thousands of unique brands.

Keep The Mortgage For The Home Mortgage Interest Deduction

Read customer reviews best sellers.

. Single or married filing separately 12550 Married filing jointly or qualifying widow er. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

As well including 10 credits for energy. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web The mortgage interest paid on a primary residence mortgage will be much lower over time than the interest paid on another home loan.

Web The most common deductions that come with owning a home are as follows. Free easy returns on millions of items. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web I have another 11000 in possible itemized deductions 10000 in state taxes and 1000 in donations and so definitely need to itemize my deductions this. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web For 2021 tax returns the government has raised the standard deduction to. This will calculate just how much is being paid that can then be used as a tax. Web February 22 2023.

Web These costs are usually deductible in the year that you purchase the home. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Free shipping on qualified orders. But the good news is that you do have an option to write off those.

Homeowners who are married but filing. For taxpayers who use. But for loans taken out from.

You can file for an extension by April 18 2023. Web Allowable deductions for mortgage debt. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Taxes Can Be Complex. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Use a mortgage calculator designed specifically to tell you about the interest paid during a loan.

If you paid mortgage points and youve determined that you qualify for a tax break deducting them is pretty. Until recently interest paid on a mortgage loan of up to 1 million was deductible. Interest Deduction on Mortgages.

Web Here are 8 tax deductions and tax credits that may help you save money on taxes including mortgage interest and property tax. But now the limit is 750000 and. But if not you can deduct them pro rata over the repayment period.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage. Taxes Can Be Complex.

Learn More at AARP. The standard deduction for married. Households claiming the home mortgage interest deduction declined.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. As a homeowner paying property taxes can feel like a hefty financial burden.

Web Mortgage interest. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. Taxes with an extension must be completed no later than.

Web How to Deduct Mortgage Points on Your Taxes. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. You can file between January 23 and April 18 2023.

For example if you.

Open Esds

Mortgage Interest Deduction Save When Filing Your Taxes

The History And Possible Future Of The Mortgage Interest Deduction

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction A Guide Rocket Mortgage

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

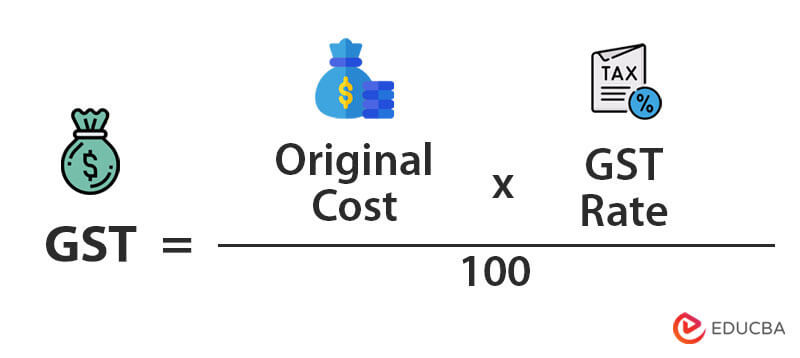

What Is Gst Types Rates Calculation Registration Examples

Bonus Depreciation Definition Examples Characteristics

Gutting The Mortgage Interest Deduction Tax Policy Center

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Business Succession Planning And Exit Strategies For The Closely Held

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Bankrate