22+ good dti for mortgage

Web In truth the idea of a good DTI exists on a spectrum depending on the type of home loan youre applying for and the specific terms youre hoping to secure. As a general rule your debt-to-income ratio should remain below 36 with no more than 28 of your income.

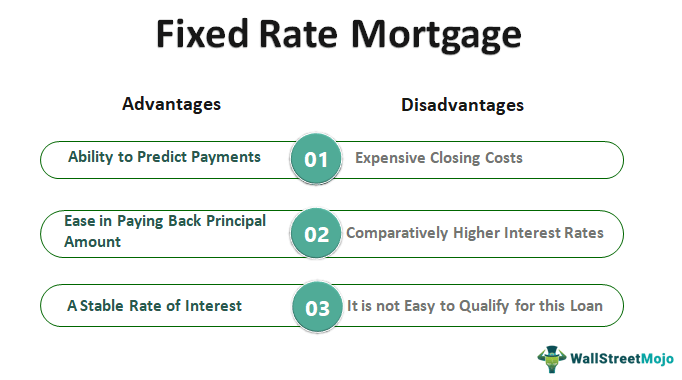

Fixed Rate Mortgage Definition Type Example Vs Variable Rate

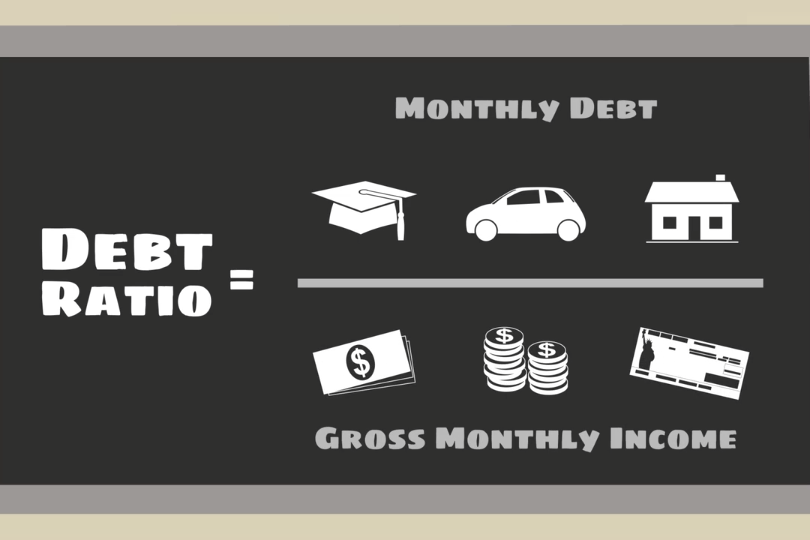

Web DTI measures your debts as a percentage of your income.

. Ad Compare Mortgage Options Calculate Payments. Comparisons Trusted by 55000000. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web Whats a good debt-to-income ratio for a mortgage. Lock Your Rate Today. Ad 10 Best House Loan Lenders Compared Reviewed.

That ratio which shows the amount of. Web You can calculate your DTI ratio in four steps. Financial professionals often recommend keeping your debt-to-income ratio under 36 when you are applying for a.

Ad 10 Best House Loan Lenders Compared Reviewed. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Borrowers with a high DTI are likely to be accepted by personal loan providers compared to mortgage.

Apply Online Get Pre-Approved Today. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Ideally lenders prefer a debt-to-income ratio lower.

Rules differ by lender but most like to see a DTI of 36. Figure out your gross monthly income. Web What is a good debt-to-income ratio for mortgages.

Ad Compare Best Mortgage Lenders 2023. Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad Compare Your Best Mortgage Loans View Rates. Get Instantly Matched With Your Ideal Mortgage Lender. On a monthly basis this would add 1000 a month to your usable income.

Calculate Your Minimum Monthly Payments. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Compare Offers Side by Side with LendingTree.

Apply Now With Quicken Loans. Lock Your Rate Today. Then divide 1700 by 4500 which equals 378.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Save Time Money. Web If youre applying for a mortgage one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

Web Generally borrowers should have a DTI ratio of 36 or lower. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Get Instantly Matched With Your Ideal Mortgage Lender.

Web To calculate your DTI add the expenses together to get 1700. Your DTI is 378. Get the Right Housing Loan for Your Needs.

Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. If your income varies estimate a.

Web Having a DTI ratio of 36 or less is considered ideal. DTI determines what type of. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Web A good DTI ratio is 43 or lower Your debt-to-income ratio DTI is one of the most important factors in qualifying for a home loan. Add up your monthly debt payments. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Many lenders may even want to see a DTI thats closer to. Conventional 15- or 30. 4 That means you have a manageable debt load and money left over after making your monthly debt.

Web Add 9000 and 15000 then divide by two to get 12000 for a two year average. 1 2 For example assume. Comparisons Trusted by 55000000.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. As perhaps the most difficult step prospective borrowers must add up all qualifying monthly payment minimums.

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

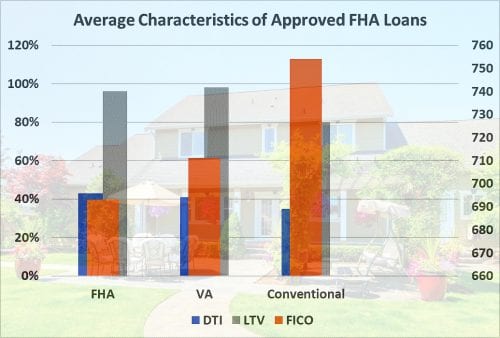

Guide To Fha Home Loans How Much Income Do You Need Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Debt To Income Ratio What Is A Good Dti For A Mortgage

What S Considered A Good Debt To Income Dti Ratio

What Is A Good Debt To Income Ratio And Why Does It Matter Mortgages And Advice U S News

Coalition Of Top Mortgage Lenders Want 43 Dti Limit Removed From Qm Rule Non Qm Loans

Debt To Income Ratio Calculator Nerdwallet

:max_bytes(150000):strip_icc()/vikki-velasquez-investopedia-portrait-1-18b989d75f1f4d6d9b5b3a47cb3ffc5f.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is A Good Debt To Income Ratio To Have In 2023

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Fha Debt To Income Ratio Requirements

Debt To Income Ratio Dti What It Is And How To Calculate It

Keisha Shannon Mortgage Loan Originator Nations Lending Linkedin

What Is A Good Debt To Income Ratio Better Mortgage